Purchasing a house is one of the most common financial milestones and it involves setting up proper planning and dedication. Wait time for a house This is one of the most frequent inquiries of homebuyers. That depends on your income, how much you save, and whether the housing market is going up or down. We will consider the big picture of how long it takes to buy a house, and we offer specific strategies to help you achieve long-term financial success.

Knowing the elements that comprise their approach to saving for a home is vital in establishing whatto expect when and planning timelines. Spend some time modelling, go through different situations and strategies, so you can have a better idea of when will you afford to buy your desired home and see what else you could make faster.

The time of it takes to save up for a house depends on many factors. Knowing what these factors are can help you to estimate how long it will take for you to save and give you the power to adjust your strategies.

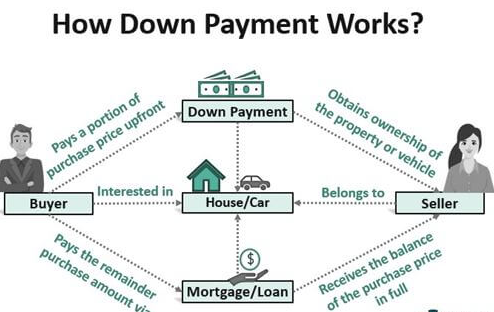

Down Payment Amount

How Much Down Payment to Put on a HouseThe amount of the down payment required is one of the most important drivers in determining how long it will take to save for a house. Fair warning though, while 20% is recommended for a down payment by traditional standards, often depending on the type of loan and lender requirements it could be higher or lower. Some programs may only be 3% down, while some others you might have to put a larger percentage Pokémon Go Download for iOS.

Income and Savings Rate

As with loan qualifications, this entirely depends on your income level and simply how much you are able to sock away a month towards the down payment. Generally, the higher a person earns with a better savings rate, the sooner they can buy into housing. Because the snap of setting up a budget will supercharge your savings to get you to that welded, steel goal sooner!

Housing Market Conditions

Market conditions in the housing market will also effect your savings. If you live in a seller’s market, and home prices are rising, you may have to save even more as costs go up. On the flip side, lower costs in a slower market could mean you need to save less, allowing you to reach your goal faster.

While this does not provide a definitate road map, it gives you an idea of where to start and allows you to quickly tailor your savings plan for buying a house based on concrete details.

How Long before You Start to Save?

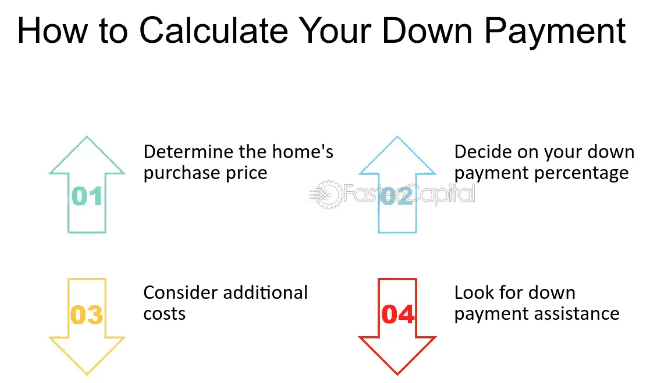

There are many factors you need to keep in mind when calculating your potential time frames to save toward buying a house. Here is a systematized manner to know about the right step which can assist speed up your period saving between each loan disbursal.

Calculate Your Target Down Payment

Calculate the Down Payment First This will vary based on your prospective home purchase price. If you were looking to buy a house around $300,000 and wanted to provide a 20% down payment you would need $60,000. But, this number is relative and may be different for other types of lending products that you are considering.

Evaluate How Much You Can Save Monthly

Then, Go Over How Much You Can Save Monthly This means that you would need to go through your budget and see where you can pull back so you can save more. Suppose you can save $500 a month for a down payment, you can determine how many years it will take to hit your goal.

Controlling for Interest and Investments Backend

Saving your money in a high-yield savings account or investing — yielding interest or returns which can reduce your savings timeline. Add these potential gains to get a better idea of how long how long it will be before you hit the target.

With these numbers you can then build the perfect house buying timeline, and set different expectations for the things that actually influence your ability to buy a home.

Shortcuts To Ramping Up Your Savings

So, if you want your road to a home of your own to get shorter then these are some game plans that might speed up the full amount waiting for you at the end.

Increase Your Income

Even a small bump in your take home pay can be the difference in going from saving 20% of your income to 30%. Think about side hustles, freelance work or more part-time jobs. But more money can just go straight into the earnest money escrow and bring you closer to being done with that part of the process.

Trim unwanted expenses

Take a look at your monthly income and available funds in each category to see where you can spend less. When you save this money or transfer them to your savings account. For example, cutting back on eating out, ending subscriptions to services that you never or rarely use, or limiting your spending on luxury items lets you throw even more toward savings.

Automate Your Savings

You can also schedule an automated savings transfer between your checking and savings account each month to insure regular saving. Automation takes the temptation to spend away and keeps you disciplined to achieve your savings target.

Utilization of these tactics may only support your savings efforts and bring you one step closer to buying a house earlier than imagined.

Here are 12 practical ways to automate your savings:

- Direct Deposit Splits

Set up a percentage of your paycheck to go directly into your savings account, so you don’t have to transfer funds manually. - Recurring Bank Transfers

Schedule regular automatic transfers from your checking to your savings account, such as weekly or monthly, with your bank. - Round-Up Apps

Use round-up apps like Acorns or Qapital, which round up each purchase to the nearest dollar and save the difference automatically. - Automated Investment Apps

Set up accounts with apps like Betterment or Stash, which automatically invest a set amount or leftover funds. - Employer Savings Programs

Participate in programs like 401(k) plans or direct savings deductions if your employer offers them, so money is saved before you see it. - High-Interest Savings Accounts

Open a high-yield savings account that transfers interest earnings back into your balance each month, boosting your savings over time. - Credit Card Cash Back Savings

Some credit cards allow you to redeem cashback rewards directly into a savings account, automating this transfer to help you save passively. - Auto-Pay Bills with Remainders Saved

Set automatic payments for bills with the remainder going into savings. This helps ensure you save anything not needed for essential payments. - Automated Emergency Fund Contributions

If you’re building an emergency fund, automate monthly or bi-weekly deposits into a separate account dedicated to this goal. - Automatic Pay Raise Contributions

Every time you receive a raise, schedule the increase to go automatically into savings or retirement accounts to save more effortlessly. - Goal-Based Savings Apps

Apps like Digit or SmartyPig allow you to set specific savings goals (e.g., vacation, down payment) and automatically transfer set amounts towards them. - Retirement Account Contributions

Automate retirement account contributions through your bank or investment account to ensure you save regularly for the future without needing to remember each time.

Example Timeline Table for Savings

An illustration of a table with many examples across different time frames to imagine how long it might take to save for a down payment on your next home.

| Month | Monthly Deposit | Cumulative Savings | Milestone |

|---|---|---|---|

| 1 | $417 | $417 | Start of savings journey |

| 2 | $417 | $834 | |

| 3 | $417 | $1,251 | |

| 4 | $417 | $1,668 | |

| 5 | $417 | $2,085 | |

| 6 | $417 | $2,502 | 50% of goal reached |

| 7 | $417 | $2,919 | |

| 8 | $417 | $3,336 | |

| 9 | $417 | $3,753 | |

| 10 | $417 | $4,170 | |

| 11 | $417 | $4,587 | |

| 12 | $417 | $5,004 | Goal reached |

Save With Retirement Accounts

Some type of retirement accounts, including a Roth IRA permits for specific withdrawals penalty-free in order to acquire your first dwelling. These funds are for retirement, but you have the flexibility to use the penalty-free toward buying a home. And, of course, I would urge you to speak with a financial advisor in order to get all the nitty gritty details around the implications and benefits.

Employer Benefits

Certain employers may match the employee contribution to a 401(k) or other retirement plan, offer financial planning services that can provide guidance on establishing a savings plan for your specific goals. Keep in mind, too, if your employer offers a 401(k) match, contributing enough to get the full-match can help open up more of your paycheck to contribute toward savings for you house.

Invest Wisely

Premium savings accounts Save your money in a low-risk investment that provides better returns than what you might make by sticking it into a traditional bank savings account. This can help grow your money faster and shorten the period you need from now to a house deposit. You should consider whether you can afford to take the high risk of losing your money — our most important goal is to help you along this path, but at no point do we advise on how and where to invest.; just remember : Never put anything more than your financial safety in investments, and consult with a financial advisor before making any decision!

The application of these tactics in your own housing search could have an enormous impact on how long it takes you to save and put yourself in a strong position for home ownership.

The different setbacks & how to avoid

Buying a home is one of the biggest financial goals most people will have, and it’s surprisingly easy to get tripped up on the path to owning your own house. Knowing about these pitfalls can help you in better navigating through your savings path.

Underestimating Costs

One of the biggest surprises for people who are new to real estate is how much it actually costs financially to buy a home, by factoring in closing costs and broker fees and money spent on moving into a space only to find surprise maintenance issues. Make sure you budget for these and save accordingly to avoid unexpected expenses that can put a strain on your wallet.

Inconsistent Savings

Your wishy-washiness with savings will only push your timeline until even further back and make it that much harder to actually reach that end goal. Set automatic transfers between accounts and track your budget being disciplined with manipulating fractions.

Not Adjusting for Market Changes

The housing market may change which could impact your target down payment. Stay on top of market trends and make changes in your plan to save accordingly whether the prices for homes are rising or falling.

Find out and address these common pitfalls, and you will be able to continue on your path to meet your goal of buying a house.

Conclusion

Keep in mind: Figuring out how long to save for a house depends on your down payment goal, how much you make, what you save per pay period and conditions in the market. Through thoughtful consideration and interesting strategies, you are able to get a good idea of how long it will take for you to save up and not go head over heels on owning your own home.

Please do keep in mind that purchasing a home is long-term saving journey. Use this guide to incorporate the knowledge and tips to help make the process a little easier on yourself and find your way into becoming a first-time homebuyer.