Paying down debt is tough, it can feel like a constant tug of war between paying off debt and saving for retirement. Luckily, there are a few easy ways to pay off debt faster and keep more of that well-deserved increase in your pocket! Using these simple strategies, you can start to paying off your loans, minimize interest costs and get yourself to financial independence down the road.

In this how-to guide, we will go over some of the best strategies and payment advice you can use to eliminate your debts faster. These tools are built to streamline your approach regardless of whether you have credit card balances, student loans, or personal loans.

Newcomers Should Focus Their Efforts on Getting Rid of Debt with the Avalanche and Snowball Method!

A tried-and-true method to get of debt quicker, is which one to pay down first. Avalanche Method and Snowball Method are two common ways you can use to pay your debts. Each method has its pros and cons, so the system you choose can play a large role in how long it takes for you to rid yourself of your debt.

Avalanche Method — this is when you pay off debts with the highest interest rates first. When you do this it lowers the interest paid out over time and potentially conquers your debt at a faster rate. List your debts by the interest rates in longest to shortest order. Having applied any additional money to the top interest debt now pay minimums on all your other debts. As with the snowball method, once your highest-interest debt is paid in full, move onto the next.

The Snowball Method, however focuses on paying off the smallest debts first. Eliminating the small debts quickly in this manner has an emotional component that gives a boost as you go. Write the debt down from the lowest you owe to the most, pay off this smallest debt first, and just make minimum payments on other debts. Once you repay a debt, take the money that you would have applied to that debt and apply it to the next smallest balance which accelerates as each subsequently smaller debt is repaid.

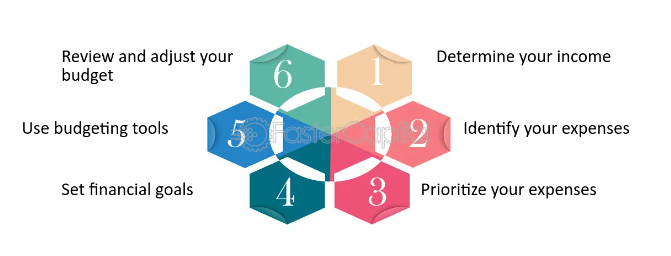

Create a Sensible Budget Plan and Stick to it

Establishing a realistic budget is important in paying off debt effectively. Having a budget in place allows you to keep an eye on what you are spending and where there might be areas that can make cutbacks so more money can go towards your debt. Itemize all of your income sources and monthly expenses. Put your spending into buckets — like housing and groceries as essentials and dining out and entertainment as non-essentials.

As soon as you have a little more payment for residence in order, consider the things that are high-end investments. This should be extra money toward your debt payments, which will allow you to become debt-free faster! You can also use budgeting tools and apps to track your spending and keep yourself honest. By examining your budget regularly, you can easily identify areas where you might need to cut back and stay on track with financial discipline.

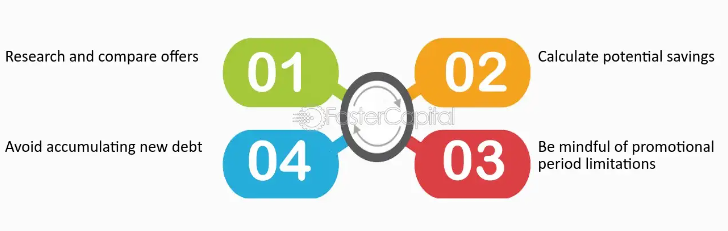

Use Balance Transfers, Refinance

Tricks like balance transfers and refinancing can help you handle debt better, saving money in interest. When you transfer a balance, you are moving credit card debt from one high-interest credit card to a new account that has an interest rate that is often 0% (introductory). By doing this it can help you pay some money towards the principal rather than just additional interest. Just make sure the balance transfer fees and the period over which you can use this promotion will actually pay off in the long run.

Simply, refinancing is when you are given out a new loan with a lesser interest rate to settle off your old debts. This can be especially helpful with student loans, personal loans, or mortgages. By refinancing, you can decrease your interest rate and monthly payments and simplify loan terms. However, before you sign on that line, weigh out the possible costs and terms of refinancing to ensure it serves your financial interests.

7 Realistic Techniques For Decrease In Regular monthly Bills

Lowering your monthly bills is a great way to find more money to pay off bills. Dropping some high-level ideas, here are seven solid strategies to help you reduce your spending.

- Negotiate Bills:Call your service providers to discuss a reduction in fees for utilities, insurance, and more.

- Likewise, you can take a look at your subscriptions and memberships and cancel any that are not in use.

- Cook at Home: By cooking meals at home rather than eating out, you can have some savings in your food bills.

- Buy Wisely: Clip the Coupons, Buy in Bulk and Shop Around for Better prices to Save on Groceries.

- Use Less Energy: Opt for energy-efficient habits (like keeping the light off in daytime and switching to LED bulbs) & avoid keeping gadgets plugged- in unnecessarily.

- Stop Impulse Buys: Make a list before you go, and stick to it so you don´t end buying things unecessary.

- Fit in Affordable Fun: Discover activities that are free or inexpensive in your community for entertainment and leisure.

You increase the number of dollars you have available to pay off your debt faster by increasing the adjustments you make in how much you spend.

A Table of Debt Reduction Methods and Their Debt Relevance

Here’s a table outlining popular debt reduction methods along with their relevance to various types of debt:

| Debt Reduction Method | Description | Relevant Debt Types |

|---|---|---|

| Debt Snowball Method | Focus on paying off the smallest debts first to build momentum and motivation. | Credit cards, personal loans, medical bills |

| Debt Avalanche Method | Prioritize debts with the highest interest rates to reduce overall interest costs over time. | Credit cards, high-interest personal loans |

| Debt Consolidation | Combine multiple debts into one loan, often with a lower interest rate and a single monthly payment. | Credit cards, personal loans, medical bills |

| Balance Transfer Credit Card | Transfer high-interest credit card debt to a card with a lower or 0% introductory rate. | Credit cards |

| Debt Management Plan (DMP) | Work with a credit counseling agency to negotiate lower interest rates and create a structured plan. | Credit cards, unsecured personal loans |

| Loan Refinancing | Refinance to secure lower interest rates or better terms, especially for large debts. | Mortgages, auto loans, student loans |

| Debt Settlement | Negotiate with creditors to pay a reduced lump-sum amount as full payment on the debt. | Credit cards, personal loans (may not apply to secured debt) |

| Bankruptcy | Legal process to discharge or restructure debts, generally as a last resort. | Unsecured debt (credit cards, medical bills), some secured debt (depending on chapter) |

| Extra Payments Strategy | Make extra payments towards principal to reduce the loan term and interest. | Mortgages, auto loans, student loans |

| Income-Driven Repayment (IDR) | For federal student loans, payments are adjusted based on income, extending the loan term. | Federal student loans |

We will look at the advantages of each strategy, and how they apply to one’s particular financial situation. With all of these combined, you can easily form a plan to reduce your debt load much faster.

Attempt #2: Emergency Fund vs Paying off Debt

You need to have an emergency fund in place no matter how much debt you are paying down. A reserve of funds provides a feeling that you can handle unexpected costs without sliding deeper into debt. Strive to have 3–6 month’s living expenses in a separate savings account for rainy days.

We must save, at the same time with paying off debt (saving less and prioritize debt repayments), but saving enough to cover for disaster))). Begin by committing to saving for an attainable emergency fund and work on growing the amount as money becomes more manageable. This balance ensures you can manage debt successfully, and you are still financial stable.

Advice on How to Balancing Paying off Debts and Saving Goals

Effectively paying down debt and pursuing your other savings goals is all about balance. Check out these ideas for finding that balance.

Spread Your Money Out: Split your budget between paying off debt and saving, so you can continue taking steps in both areas.

Create realistic objectives -define attainable debt reduction targets as well as savings, and if the need be, revise your plan.

Monitor How Bear you come: Make the habit of checking your savings plan as well as budget sheet to know that how closer and far are you moving from target.

In doing so, with these tips in mind, you can find a balanced approach when it comes to managing debt and saving for the things you want — and have more financial stability.

Why Keeping Score Matters & You Need A Plan to Match

Half of the debt repayment success is to monitor your progress towards paying it off and finely tune your plan. Watching your dollars and balance on a daily, weekly, monthly basis is important so that you can measure how far you have come or what changes are needed to get back on course.

Track Your Debt Repayment & Savings- Utilise budgeting apps, spreadsheets or financial journals and track it all so you can see how much you have repaid & saved. Monitor your budget regularly and tweak it accordingly. When you experience financial changes, such as a job loss or increase in unexpected costs, revise your strategy to accommodate these needs.

Drive — Sticking to Your Debt Repayment Goals

One of the most important factor to being able to paying off debt is actually sticking with it for a while. Maintain focus by setting short-term and long-term goals, and remember to celebrate small victories. Share your goals with a friend or family member — this can hold you accountable (in the best way), and they can encourage you, too!

Also, keep these three major advantages of being debt-free uppermost in your thoughts: more financial freedom, less stress and better credit scores. You Might Like // With the proper motivation and follow through, you will be able to endure through any and all roadblocks that arise in your life.

Conclusion

In other words…the minor tweaks to pay off debt sooner can make a massive difference in the overall health of your financial life and help you demolish that debt quicker. But with a little bit of work up front in focusing on your debts, crafting some solid numbers for your budget, cutting back by trimming over the top costs into necessities and using debt reduction strategies as needed — you can make significant steps through those financial goals!

Balance paying down debt with having an emergency fund and making sure you are keeping metrics of your progress on paper (or digitally). Through hard work and planning on the others passing, you can achieve financial freedom and enjoy life without debts.