A rainy day fund is the foundation of financial security, providing a cushion that bails singles out during unforeseen events such as medical emergencies, car breakdowns or job loss. Establishing this fund requires careful planning and disciplined saving. This article will explain how to develop a solid financial cushion, or emergency fund, in order to be prepared for unexpected events.

The Importance of an Emergency Fund

An emergency fund being a good idea, is not anything new—it is absolutely vital to remaining financially secure. With that said, life is unexpected and having a specific person has the ability to keep you from moving further into debt when the unexpected happens. The case for building a rainy day fund in your emergency savings account

Debt Reduction: When faced with a surprise purchase, your savings can prevent you from having to rely on credit cards or loans that can cause debt to grow out of control and high-interest charges.

Ability to Remain Calm: Its a sweet sound knowing you have this pile of cash waiting for emergency, reducing stress and anxiety when emergencies arise.

Long-term Financial Goals: It should keep unforeseen expenses from becoming an obstacle that prevents you from meeting your long-term financial goals, like retirement savings or a big-ticket item.

That said, let us dig deep into some intelligent emergency fund-building tips to get you on the right track.

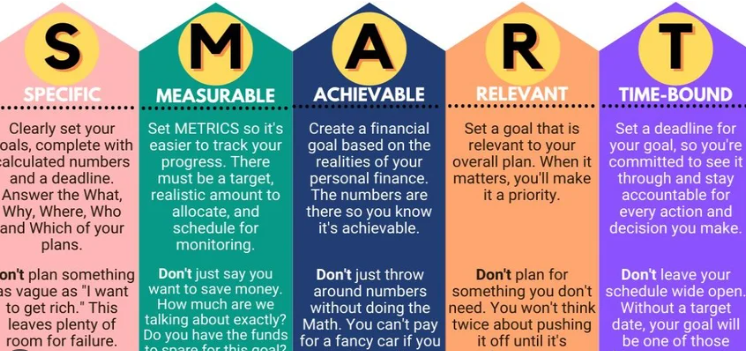

Establishing measurable financial objectives

The first step in building an emergency fund is setting goals that are clear and realistic. And it only takes one such slip up for the lack of specific goal to make us lose interest and stop our efforts in its tracks. This is How You Can Create the Right Financial Goals For Your Emergency Fund

Set Your Goal

Emergency Fund Target (the amount of money you should keep in cash) Most financial experts suggest saving enough to cover three to six months of living expenses. Sum up your monthly expenses ( rent/mortgage, utilities, groceries/insurances) for the no. of months you want to provide.

Break Down Your Goal

After you have a goal figure, divide it into smaller achievable goals. So if your goal is to save $12,000 over the course of a year, choose monthly savings goals based on $1,000. This will prevent you from overwhelming yourself with having to do something, and makes it easier for you to keep track on your progress.

Set a Deadline

Create a Time Frame for Reaching your Emergency Fund Goal Deadlines serve as a great pressure for those who need something to get excited. But having a deadline, whether it be in 6 months or a year, will keep you on track and push yourself to make it happen.

Ways How To Save Money on Airbnb

You can implement some good strategies that will save you money at the faster pace and will help to make your emergency fund much faster than you think. Here are some tried and tested ways to increase savings:

Automate Your Savings

The key to saving regularly is automatic savings. Automate the system: Have a set amount automatically transferred every payday to an emergency fund account from your checking account. Automating your savings eliminates the risk of spending the saved money and ensures you build up a fund.

Cut Unnecessary Expenses

Go over how much you spend each month and figure out where you can afford to cut back. It may be to eat out less or cancel a subscription you do not use enough or to simply spend less on frivolous things. Even more effectively, redirect this money into your emergency fund to help you get there even faster!

Increase Your Income

Find ways to increase your income by picking up a side hustle, freelancing or selling things you no longer need. Extra cash can go right to an emergency fund, and you soon will be at the $1k goal.

20 Smart Tips for Building an Emergency Fund

This is a table is listing similar ideas, hoping to give you some direction for start working on your emergency fund, categorizing them according its purpose and efficiency :

- Create a “No Spend Day” Calendar: Set specific “no spend” days each month and add the unspent amount to your emergency fund.

- Save Your Grocery Coupons: Skip using some grocery coupons and add the savings to your fund instead.

- Host a Virtual Yard Sale: Use online marketplaces to sell unused items and earmark the profits directly for emergencies.

- Outsource Side Hustle Tasks: Offer smaller tasks or services in your neighborhood, like pet sitting or organizing closets, and stash the earnings away.

- Reward Yourself with “Leftovers”: Anytime your grocery or entertainment budget is under limit, save the remaining amount.

- Repurpose Unused Gift Cards: Sell any unused gift cards or redeem them and save the equivalent cash value.

- Create an “Emergency Fund Jar”: Physically set aside spare change and small bills at home to build an emergency cash jar.

- Match Your Monthly Streaming Fees: For every subscription service you keep, match the amount and transfer it to your emergency fund.

- Upskill for Income Boosting: Take free or low-cost online courses to improve your skills for a higher-paying job or raise.

- Redirect Seasonal Expense Savings: For months when you spend less on heating, cooling, or commuting, redirect those funds into savings.

- Cashback to Cash Stash: Use credit card cash back or store rebates for emergency funds rather than spending.

- No-Impulses Week Challenge: Avoid impulsive buys for a week each month and save what you would have spent.

- Automate “Round Down” Transfers: Each payday, round down your checking account to the nearest hundred and transfer the difference.

- Repurpose Birthday Money: Instead of spending birthday money, deposit it directly into your emergency fund.

- Save Your Receipts Challenge: For every item with a receipt you don’t need (returns), add an amount equal to its cost into savings.

- Utility Bill “Challenge”: Each month, challenge yourself to lower your utility bill and save the difference.

- Automate Tax Refunds to Savings: Directly deposit any tax refunds into your emergency fund instead of checking.

- “Skip It” Days: Designate days to skip optional purchases (coffee, takeout) and save those skipped expenses.

- Redirect Extra Paychecks: If you’re paid bi-weekly, some months have an extra paycheck—direct that extra pay to savings.

- Monetize a Hobby Just for Savings: If you enjoy crafts, cooking, or a niche skill, sell items/services just to fuel your emergency fund.

Monitor Your Progress Consistently

Watching your progress is important to keep yourself motivated and to ensure you are on the right way of saving up in order to reach your EF goal. Well, here are a few better practices for monitoring your savings progress

Use Budgeting Apps

Desktop Tools from Mint, YNAB (You Need a Budget), or Personal Capital: These are free budgeting apps that can help you keep track of savings and expenses. These are tools that allow you to see where your money is going and track how close you are to reaching your emergency fund goal.

Milestones & Rewards

The journey is a long one, and milestones are important: for example, put your target for 25%, 50% or even 75%. The key is to celebrate these successes, help yourself stay motivated, and reflect upon how far you have come. Just knowing that someone is proud of you can lift your spirits and motivate you to keep going.

Review and Adapt Frequently

Check and see at intervals in a year if your budgeting plan and s or savings strategy are to reinforce what you need regarding personal finance goals. In case you see that progress has not been up to your expectation, tweak the plan by slashing more expenses and bumping up your saving rate or finding alternative ways to maximize your income.

Emergency fund and financial planning are like synonyms to each other within personal finance.

Emergency fund is an Inevitable Ingredient in Financial Planning. It builds not only a safety net, as but could also stand to your long-term financial wellbeing. Why You Need an Emergency Fund

Guaranteed Financial Security

Emergency funds provide resilience and securityeconomic stability, financial backup. It makes sure that you are able to pay for unforeseen expenses without throwing your finances into a tailspin or running up high-interest debt.

Supports Long-Term Goals

By having an emergency fund, you will be less likely to pull from other savings that are earmarked for long-term goals such as retirement or education. This way, you can meet your money goals and not sacrifice being prepared for potential emergency situations.

Improves Financial Flexibility

Who understand what emergencies might happen, correct?! An emergency fund allows for some flexibility in managing the rest of your funds. When an unexpected medical bill, car repair or job loss comes up you can pay for it with your cash cushion and prevent [to the best of our ability] financial setbacks.

Conclusion for Building an Emergency Fund

Establishing an emergency fund is an essential part of gaining financial security and confidence. In conclusion, you are preparing yourself against financial uncertainties by setting clear goals, employing effective savings strategies, monitoring your progress and realizing the necessity of an emergency fund.

Integrate these intelligent tips to save in a crisis into your financial plan and take strides towards a safer future. By working hard and making constant changes in your life, you may save a loss of money that can be used for the day — also to provide stability when facing unforeseen challenges.